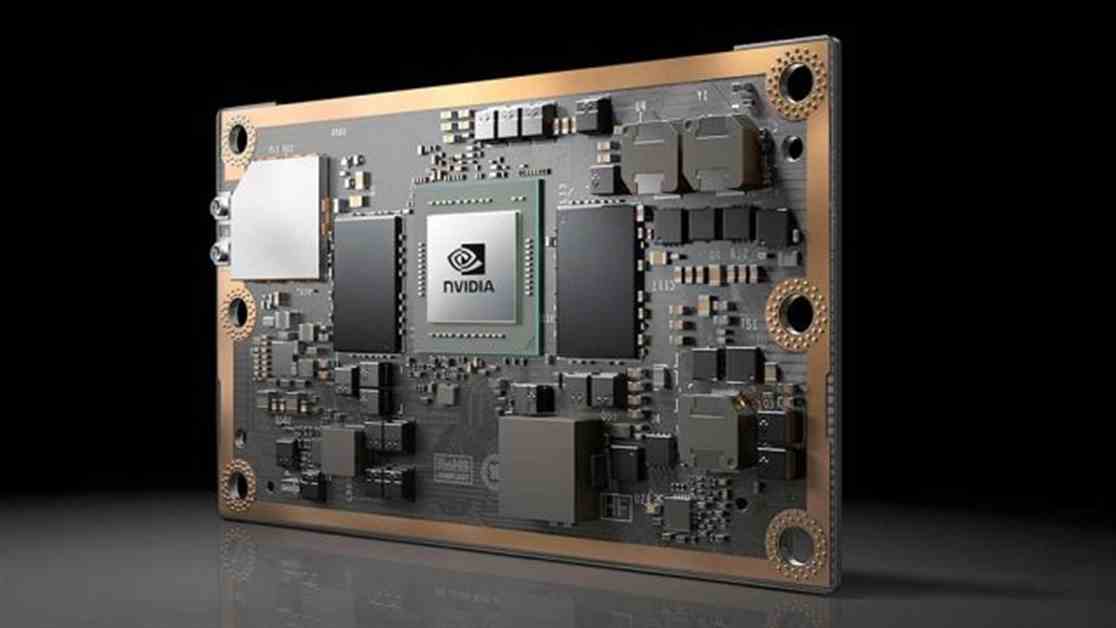

Nvidia Hits New All-Time High Due to Surge in AI Chip Demand

Nvidia (NVDA) has reached a new all-time high, sparking interest among investors. The surge in demand for AI chips has played a significant role in this achievement. Hewlett Packard Enterprise (HPE) recently announced strong demand for its AI servers, which utilize Nvidia’s H100 chips. This comes as Hewlett Packard Enterprise’s CEO, Antonio Neri, highlighted Nvidia’s leadership in generative AI. The demand for servers spans across enterprise customers, sovereign states, and hyperscale operations handling workloads for various entities.

Furthermore, Nvidia is set to implement a 10-for-1 stock split, effective Friday, and plans to unveil its most advanced artificial intelligence platform in 2026. The company’s strategic use of next-generation memory is expected to enhance processing time.

Foxconn revealed plans to construct an advanced computing center in Taiwan, utilizing Nvidia’s Blackwell chips. This collaboration follows Nvidia’s partnership with Foxconn to establish data centers for expansion into autonomous driving and the electric vehicle market. Notably, Tesla (TSLA) currently utilizes Nvidia’s chips, although it intends to custom build them in the future.

Recent milestones for Nvidia include surpassing the $1,100 mark for its shares, with Tesla’s CEO Elon Musk hinting at a partnership with Nvidia for his AI startup xAI. Additionally, Nvidia’s market cap nears $3 trillion, aligning with Microsoft’s (MSFT) achievement in the stock market.

The company’s first-quarter results also shine, as sales soared by 262% to $26 billion, while earnings reached $6.12 per share, marking a 461% increase. Nvidia’s collaboration with Microsoft to provide the latest AI software on its graphic processing units showcases its commitment to innovation.

With a focus on expanding its AI capabilities, Nvidia acquired Run.ai for $700 million, aiding developers in utilizing AI tools effectively. This move aligns with Nvidia’s Cloud AI product, offering businesses instant access to an AI supercomputer.

Overall, Nvidia’s strategic advancements in AI technology position it as a key player in the industry. The company’s success in various sectors, including gaming, health care, automobiles, and robotics, underscores its innovation and growth potential. As the AI chip market continues to expand, Nvidia remains at the forefront of driving advancements in computing and AI applications.