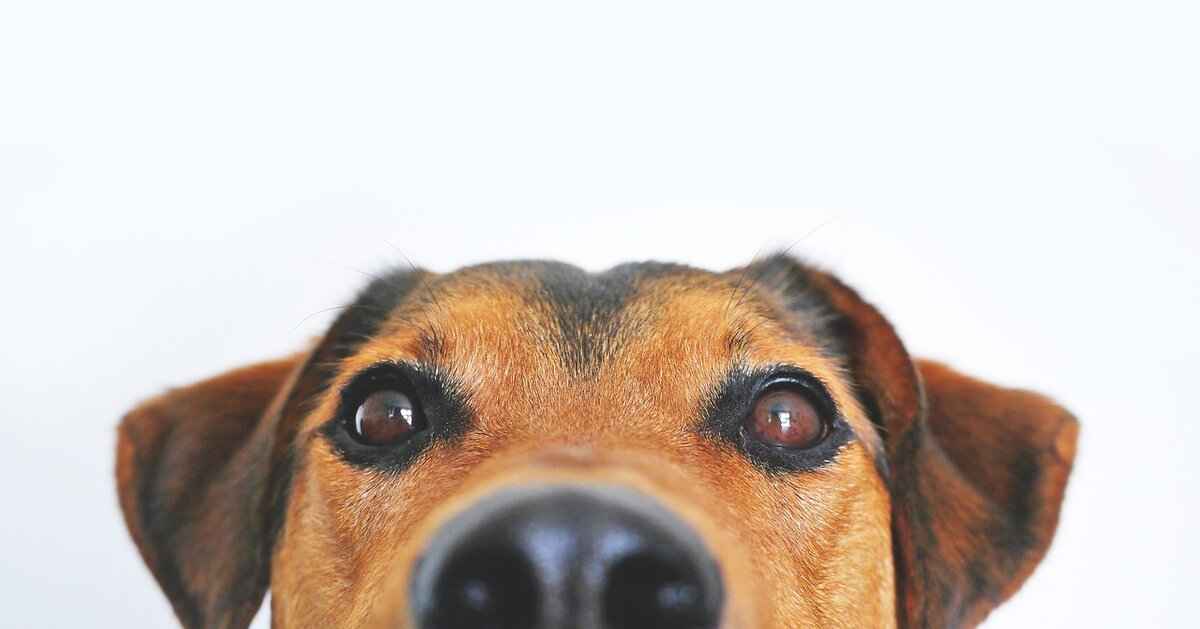

This article delves into the appearance of tick bites on dogs, the symptoms to monitor, and essential information for pet owners to ensure their furry friends remain healthy and tick-free.

Understanding the appearance of tick bites on dogs is crucial for early detection and treatment. Tick bites can differ in appearance based on the tick species and the dog’s individual reaction. Some ticks may leave a small, red mark, while others can cause significant irritation and swelling.

- Redness: A common reaction around the bite site.

- Swelling: This may occur as the body’s immune response kicks in.

- Presence of the Tick: Finding the tick itself is a key indicator of a bite.

Common symptoms associated with tick bites include:

- Localized swelling around the bite site.

- Increased scratching or licking of the affected area.

- Behavioral changes, such as signs of discomfort or lethargy.

It is essential to monitor for potential health risks associated with tick bites. Dogs can suffer from serious conditions such as Lyme disease, which can lead to chronic health issues if not treated promptly. Other tick-borne diseases include Ehrlichiosis and Anaplasmosis, both of which require veterinary attention.

Preventive measures are vital to protect dogs from tick bites. Regular tick checks and the use of effective tick preventatives, such as topical treatments and collars, can significantly reduce the risk of infestation. Consulting with a veterinarian can help you choose the best options for your dog.

Knowing when to see a veterinarian is essential. Signs of infection, such as pus or persistent swelling, require immediate attention. Additionally, if your dog exhibits symptoms like fever or joint pain, seeking veterinary care promptly can prevent serious complications.

In conclusion, monitoring for tick bites and understanding their implications is critical for dog owners. By taking proactive steps and being aware of the signs, you can help ensure your dog’s health and well-being.

Understanding Tick Bites on Dogs

Tick bites on dogs can present a variety of appearances, influenced by factors such as the species of tick and the individual dog’s response to the bite. Recognizing these variations is essential for pet owners to ensure timely intervention and care.

Ticks are small arachnids that attach themselves to the skin of dogs to feed on their blood. Depending on the tick species, the bite may appear as a small red dot or a more pronounced area of inflammation. For instance, the deer tick may leave a bite that is less noticeable at first, while the American dog tick can cause more significant swelling and irritation.

The dog’s reaction to the bite can also vary. Some dogs may experience mild irritation, leading to slight redness and a small amount of swelling around the bite site. In contrast, other dogs may have an allergic reaction, resulting in more severe symptoms such as extensive swelling, increased warmth, and discomfort.

Additionally, monitoring for the presence of the tick itself is crucial. Finding the tick still attached to the skin can help in assessing the potential risk of tick-borne diseases. It’s important to know how to safely remove the tick to minimize the risk of infection and disease transmission.

In summary, understanding the appearance of tick bites on dogs and recognizing the symptoms associated with them is vital for dog owners. By staying vigilant and informed, you can ensure your furry companion remains healthy and free from the dangers of tick bites.

Common Symptoms of Tick Bites

Identifying symptoms associated with tick bites is crucial for dog owners to take prompt action and ensure the health of their furry friends. Tick bites can lead to various reactions in dogs, ranging from mild irritation to serious health complications. Recognizing these symptoms early can make a significant difference in treatment outcomes.

When a dog is bitten by a tick, the most common symptoms to watch for include redness and swelling around the bite area. These initial reactions can indicate an allergic response or an infection, both of which require monitoring. If you notice persistent redness or swelling that increases over time, it is essential to consult a veterinarian.

In addition to localized symptoms, dogs may exhibit behavioral changes after a tick bite. Increased scratching, licking, or signs of discomfort can indicate that your dog is feeling unwell due to the tick bite. Observing these changes can help you assess the severity of the situation and decide on the best course of action.

Another important sign to look for is the actual presence of the tick. If you find a tick embedded in your dog’s skin, it is crucial to remove it safely and promptly to minimize the risk of disease transmission. Always use proper tick removal techniques to avoid leaving parts of the tick behind, which could lead to infection.

In summary, being vigilant about the symptoms associated with tick bites can help dog owners take timely action. Regular checks for ticks, along with monitoring for any unusual symptoms, can protect your dog from potential health risks associated with tick bites.

Physical Signs of Tick Bites

When it comes to tick bites on dogs, being aware of the physical signs is crucial for early detection and treatment. The initial reaction to a tick bite often manifests as localized swelling and redness around the bite site. These symptoms can vary in intensity, depending on the dog’s sensitivity and the tick species involved.

In many cases, the area surrounding the bite may become inflamed, indicating the body’s immune response to the foreign substance introduced by the tick. This localized swelling is often accompanied by redness, which can range from a mild pink hue to a more pronounced crimson shade. Observing these changes is essential, as they can provide insights into the severity of the bite and potential allergic reactions.

Additionally, the presence of a tick itself is a significant indicator of a bite. If you discover a tick embedded in your dog’s skin, it is crucial to remove it promptly and correctly to minimize the risk of disease transmission. Failure to do so can lead to further complications, including infections or the spread of tick-borne diseases.

Another important aspect to consider is the potential for secondary infections. If the bite site shows signs of pus, increased swelling, or persistent redness, these could be signs of infection, necessitating immediate veterinary attention. Monitoring your dog’s behavior is equally important; if you notice increased scratching or signs of discomfort, it may indicate a more serious issue.

In summary, being vigilant about the physical signs of tick bites, such as localized swelling and redness, is vital for ensuring your dog’s health. Quick identification and appropriate action can make a significant difference in preventing complications.

Redness and Swelling

are frequent and noticeable reactions in dogs following a tick bite. These symptoms are often the body’s response to the tick’s saliva, which can contain various allergens. It is essential for pet owners to monitor these signs closely, as they can indicate more severe reactions, including an allergic response or potential infection.

When a dog is bitten by a tick, the area around the bite may become red and swollen. This localized inflammation is a natural response and can vary in intensity based on the dog’s sensitivity and the duration the tick was attached. If the redness and swelling persist or worsen, it could signify an underlying issue that requires veterinary attention.

- Allergic Reactions: Some dogs may develop an allergy to tick saliva, leading to severe swelling and redness. This can cause discomfort and may require antihistamines or other medications.

- Infection Risks: If the tick is not removed promptly, the bite site may become infected. Symptoms of infection include increased redness, warmth, and discharge. If these symptoms appear, immediate veterinary care is crucial.

- Behavioral Changes: Dogs may also exhibit signs of discomfort, such as increased scratching or licking at the bite site. Monitoring your dog’s behavior can provide additional clues about their condition.

It is vital for pet owners to remain vigilant after a tick bite. Regularly checking your dog for ticks, especially after outdoor activities, can help prevent complications. If you notice persistent redness and swelling, or if your dog shows signs of distress, consulting a veterinarian is essential for ensuring their health and well-being.

In conclusion, while redness and swelling are common responses to tick bites, they should not be overlooked. Understanding these symptoms and taking appropriate action can help keep your furry friend safe and healthy.

Presence of the Tick

Finding a tick on your dog is a critical indicator that a bite has occurred. Recognizing the presence of a tick is essential for preventing potential health risks associated with tick bites. Ticks are small, parasitic arachnids that can attach to your dog’s skin, feeding on their blood and potentially transmitting harmful diseases.

When you discover a tick on your dog, it is important to act quickly. Here are some key steps to follow:

- Stay Calm: It’s natural to feel alarmed, but staying calm will help you handle the situation better.

- Use Proper Tools: A pair of fine-tipped tweezers or a tick removal tool is ideal for removing ticks safely.

- Grasp the Tick: Grasp the tick as close to your dog’s skin as possible. Pull upward with steady, even pressure. Avoid twisting or jerking, as this can cause the mouth-parts to break off and remain in the skin.

- Clean the Area: After removal, clean the bite area and your hands with rubbing alcohol or soap and water.

- Monitor Your Dog: Keep an eye on the bite area for signs of infection, such as redness or swelling, and watch for any behavioral changes in your dog.

Knowing how to safely remove a tick is essential in preventing further complications. If you are unsure about the removal process or if the tick is embedded deeply, it is advisable to consult your veterinarian. They can provide guidance and ensure that your dog remains healthy and free from tick-borne diseases.

In conclusion, recognizing the presence of a tick and understanding how to remove it properly can significantly reduce the risk of disease transmission. Regular checks and preventive measures are key to keeping your furry friend safe.

Behavioral Changes in Dogs

can often be indicative of underlying health issues, particularly following a tick bite. When a dog is bitten by a tick, it may display various behavioral alterations that can serve as important signals for pet owners.

One of the most noticeable changes is an increase in scratching or licking at the site of the bite. This behavior may stem from discomfort or irritation caused by the tick’s presence. Dogs may also become more restless than usual, unable to settle down due to the discomfort they are experiencing.

In addition to physical signs, dogs may exhibit signs of anxiety or irritability. A normally calm dog might become agitated or withdrawn, avoiding interactions with family members or other pets. Such behavioral shifts can be a direct response to the pain or unease caused by the tick bite.

Another significant behavioral change to watch for is a decrease in appetite. If a dog is feeling unwell due to a tick bite, it may lose interest in food or treats, which is a clear indication that something is amiss. Conversely, some dogs may exhibit increased thirst or changes in their drinking habits as a response to discomfort.

It is essential for dog owners to be vigilant and monitor their pets closely for these behavioral changes. If you notice any of these symptoms, it is advisable to consult a veterinarian promptly. Early intervention can help prevent more serious complications related to tick bites, such as the transmission of tick-borne diseases.

In conclusion, understanding the behavioral changes that may occur after a tick bite is crucial for maintaining your dog’s health. By recognizing these signs early, you can take appropriate action to ensure your furry friend remains happy and healthy.

Potential Health Risks Associated with Tick Bites

Tick bites pose a significant threat to your dog’s health, potentially leading to a variety of serious illnesses. Understanding these risks is essential for all pet owners to ensure their furry companions remain healthy and safe.

Understanding Tick-Borne Diseases

Ticks are notorious carriers of several diseases that can affect dogs. Among the most prevalent is Lyme disease, which is caused by the bacterium Borrelia burgdorferi. This disease can lead to severe health complications if not diagnosed and treated promptly.

Symptoms of Lyme Disease

- Fever

- Loss of appetite

- Joint pain and swelling

- Lethargy

Recognizing these symptoms early can significantly improve the chances of recovery. If you notice any of these signs, it is crucial to consult your veterinarian immediately.

Other Tick-Borne Illnesses

Besides Lyme disease, ticks can transmit other serious illnesses, including:

- Ehrlichiosis: A bacterial infection that can cause fever, lethargy, and weight loss.

- Anaplasmosis: This disease affects the dog’s blood cells, leading to symptoms like fever, joint pain, and vomiting.

- Babesiosis: A protozoan infection that can cause severe anemia and fever.

The Importance of Prevention

Preventing tick bites is crucial in safeguarding your dog’s health. Regular tick checks, the use of preventive medications, and maintaining a clean environment can significantly reduce the risk of tick infestations.

Conclusion

Awareness of the potential health risks associated with tick bites is vital for every dog owner. By staying informed and taking proactive measures, you can help ensure your dog’s well-being and protect them from serious health issues.

Lyme Disease in Dogs

Understanding Lyme Disease in Dogs

Lyme disease is a significant concern for dog owners, as it is one of the most prevalent tick-borne illnesses affecting our furry companions. This disease is caused by the bacterium Borrelia burgdorferi, which is transmitted through the bite of infected ticks, primarily the black-legged tick (also known as the deer tick). Early recognition of Lyme disease symptoms is essential for effective treatment and improved outcomes.

Symptoms to Recognize

Dog owners should be vigilant in observing their pets for signs of Lyme disease, which can manifest in various ways. Common symptoms include:

- Lethargy: A noticeable decrease in energy levels.

- Joint Pain: Dogs may exhibit limping or reluctance to move.

- Fever: An elevated body temperature can indicate infection.

- Loss of Appetite: A sudden change in eating habits may occur.

- Swollen Joints: Inflammation can lead to visible swelling in the joints.

Diagnosis and Treatment

If you suspect your dog may have Lyme disease, it is crucial to seek veterinary care promptly. Diagnosis typically involves blood tests to detect antibodies against the bacteria. Treatment usually includes antibiotics, which can effectively eliminate the infection if administered early. The duration of treatment may vary, but many dogs show improvement within a few days.

Preventive Measures

Preventing Lyme disease is essential for your dog’s health. Here are some effective strategies:

- Regular Tick Checks: Inspect your dog for ticks after walks in wooded or grassy areas.

- Use of Tick Preventatives: Consult your veterinarian about appropriate tick prevention products.

- Vaccination: In some regions, Lyme disease vaccines are available and can provide additional protection.

Conclusion

Awareness and proactive measures are key to keeping your dog safe from Lyme disease. By recognizing symptoms early and implementing preventive strategies, you can significantly enhance your pet’s well-being and health.

Other Tick-Borne Diseases

Ticks are not only carriers of Lyme disease but also transmit a variety of other serious conditions that can affect both dogs and humans. Understanding these diseases is crucial for dog owners who wish to protect their pets from the potential dangers associated with tick bites.

- Ehrlichiosis: This disease is caused by bacteria that infect white blood cells, leading to symptoms such as fever, lethargy, and loss of appetite. If left untreated, Ehrlichiosis can result in severe complications and even death.

- Anaplasmosis: Similar to Ehrlichiosis, Anaplasmosis affects the blood and can cause joint pain, fever, and lethargy in dogs. Early detection and treatment are essential for a positive outcome.

- Babesiosis: This parasitic infection affects red blood cells and can lead to anemia. Symptoms include fever, weakness, and jaundice. Babesiosis can be severe, so prompt veterinary attention is necessary.

- Rocky Mountain Spotted Fever: Caused by a specific type of bacteria, this disease can lead to serious health issues, including organ failure. Symptoms often include fever, rash, and joint pain.

Awareness of these tick-borne diseases can empower dog owners to take proactive measures in protecting their pets. Regular veterinary check-ups, vaccinations, and preventive treatments can help mitigate the risks associated with ticks.

In conclusion, being informed about the various diseases that ticks can transmit is vital for ensuring the health and well-being of your dog. Regular tick checks and timely veterinary consultations can make a significant difference in preventing these illnesses.

Preventing Tick Bites on Dogs

Ticks pose a significant threat to our canine companions, leading to various health complications if not addressed promptly. Preventive measures are essential for protecting dogs from ticks. This section covers effective strategies to minimize the risk of tick infestations.

- Regular Grooming: Regular grooming is not only a bonding activity but also an effective way to detect ticks early. Brush your dog’s coat thoroughly, paying special attention to areas where ticks are likely to hide, such as behind the ears, under the legs, and around the tail.

- Use of Tick Preventatives: Consider using veterinarian-approved tick preventatives. Options include topical treatments, oral medications, and collars designed to repel ticks. Always consult with your veterinarian to choose the best product for your dog’s specific needs.

- Avoiding Tick-Infested Areas: During walks or outdoor activities, try to avoid tall grass, dense bushes, and heavily wooded areas where ticks are more likely to thrive. Stick to well-maintained paths to reduce exposure.

- Creating a Tick-Free Yard: Maintain your yard by keeping grass trimmed and removing debris where ticks can hide. Consider using tick-repellent landscaping techniques, such as creating a barrier of wood chips or gravel between wooded areas and your yard.

- Regular Veterinary Check-ups: Schedule regular veterinary visits to monitor your dog’s health and discuss the best tick prevention strategies. Your vet can provide insights into the prevalence of tick-borne diseases in your area.

By implementing these preventive measures, you can significantly reduce the risk of tick infestations on your dog. Awareness and proactive care are key to keeping your furry friend healthy and happy.

Regular Tick Checks

are an essential part of maintaining your dog’s health and preventing tick-borne diseases. By performing these checks routinely, pet owners can catch any tick infestations early, which is crucial for effective treatment and minimizing health risks. Understanding how to properly check your dog for ticks is a vital preventive step that every responsible pet owner should undertake.

Ticks are often found in grassy and wooded areas, and they can latch onto your dog during walks or outdoor playtime. Therefore, it is important to conduct a thorough examination after each outdoor excursion. Here’s how to effectively check your dog for ticks:

- Choose the Right Time: Conduct tick checks after your dog has been outdoors, especially in tall grass or wooded areas.

- Inspect All Areas: Pay close attention to common hiding spots such as behind the ears, under the legs, and around the tail.

- Use Your Hands: Run your fingers through your dog’s fur, feeling for any unusual bumps or textures that may indicate a tick.

- Look for Signs: Be on the lookout for any redness, swelling, or irritation, which could indicate a tick bite.

In addition to regular checks, using tick preventatives such as topical treatments or collars can significantly reduce the likelihood of tick bites. It’s advisable to consult with your veterinarian to determine the best options tailored to your dog’s needs.

In conclusion, being proactive with regular tick checks not only helps in early detection of ticks but also contributes to your dog’s overall health and well-being. By incorporating these practices into your routine, you can create a safer environment for your furry friend.

Use of Tick Preventatives

Protecting your dog from ticks is essential for maintaining their health and well-being. Utilizing tick preventatives such as topical treatments, collars, and oral medications can significantly reduce the likelihood of tick bites. These products work by repelling or killing ticks before they have a chance to attach to your pet’s skin.

Topical treatments, often applied directly to the skin, typically contain insecticides that are effective against ticks and other parasites. These treatments can last for several weeks, providing ongoing protection. On the other hand, collars infused with tick-repelling chemicals offer a convenient and long-lasting solution. They release active ingredients that spread across the dog’s skin and fur, creating a protective barrier.

Oral medications are another option, which work systemically to prevent ticks from attaching. These medications are usually administered monthly and can be particularly effective for dogs that spend a lot of time outdoors.

It is crucial to consult with a veterinarian to determine the best options for your dog based on their lifestyle, health status, and any potential allergies. Your veterinarian can provide tailored recommendations that suit your pet’s needs, ensuring maximum effectiveness and safety.

In addition to using tick preventatives, regular grooming and tick checks are vital practices that every dog owner should adopt. By examining your dog for ticks after walks or outdoor activities, you can catch any infestations early and take appropriate action.

Overall, a proactive approach combining preventive products and regular monitoring will help keep your furry friend safe from ticks and the diseases they can carry.

When to See a Veterinarian

Understanding when to consult a veterinarian after your dog has been bitten by a tick is essential for ensuring their health and well-being. While many tick bites may seem harmless, there are specific signs and symptoms that should prompt immediate veterinary attention.

Signs Indicating the Need for Veterinary Care

- Signs of Infection: If you notice pus, increased swelling, or persistent redness around the bite site, these could be indicators of an infection. Infections can escalate quickly, so it is vital to seek veterinary care.

- Persistent Symptoms: Symptoms such as lethargy, fever, or joint pain that do not improve within a day or two require professional evaluation. These signs can be indicative of tick-borne diseases that need prompt treatment.

- Behavioral Changes: If your dog exhibits unusual behavior, such as increased scratching, licking the bite area excessively, or showing signs of discomfort, it is essential to consult with a veterinarian. Behavioral changes can signal underlying issues related to tick bites.

- Presence of the Tick: If you find a tick attached to your dog, it is important to remove it safely. However, if you are unsure about the removal process or if parts of the tick remain embedded in the skin, seek veterinary assistance.

- Allergic Reactions: Some dogs may have allergic reactions to tick bites, which can manifest as severe swelling, difficulty breathing, or hives. If you observe any of these symptoms, it is crucial to seek emergency veterinary care.

In conclusion, being vigilant about your dog’s health following a tick bite is vital. Recognizing the signs that necessitate a veterinarian’s attention can make a significant difference in your dog’s recovery and overall health. Always err on the side of caution, and when in doubt, consult your veterinarian for guidance.

Signs of Infection

in dogs can be serious and require immediate attention from a veterinarian. When a dog suffers from a tick bite, it is essential for pet owners to monitor their pets closely for any signs of complications. While some reactions to tick bites may be mild, others can escalate into more severe health issues.

Common indicators of infection include:

- Pus: This may appear around the bite site, indicating that the body is fighting an infection.

- Increased Swelling: If the area around the bite becomes significantly more swollen over time, it may signal an infection.

- Persistent Redness: Redness that does not subside can be a sign of inflammation and potential infection.

- Foul Odor: An unusual smell emanating from the bite site can indicate that bacteria are present.

- Fever: A rise in body temperature may accompany an infection, suggesting that the dog’s immune system is responding.

- Loss of Appetite: If your dog is eating less or refusing food, it could be a sign of discomfort or illness.

If you notice any of these symptoms, it is imperative to seek veterinary care as soon as possible. Delaying treatment can lead to more serious health complications, including systemic infections that could affect other organs. A veterinarian can provide the necessary care, which may include antibiotics or other treatments to help your dog recover.

In conclusion, being vigilant about the signs of infection following a tick bite can make a significant difference in your dog’s health. Regular check-ups and prompt responses to concerning symptoms are essential practices for responsible pet ownership.

Persistent Symptoms

in dogs following a tick bite can be a cause for concern. If your furry friend exhibits signs such as lethargy, fever, or joint pain, it is crucial to take these symptoms seriously and seek veterinary care without delay. Early intervention is key in preventing more serious health complications that can arise from tick-borne diseases.

Tick bites can lead to a variety of health issues, and the symptoms may not always appear immediately. Lethargy can manifest as a noticeable decrease in energy levels or enthusiasm for activities that your dog typically enjoys. If your dog seems unusually tired or disinterested in play, it may be a sign that something is wrong.

A fever is another critical symptom that should not be overlooked. It can be challenging to determine if your dog has a fever without a thermometer, but signs may include warmth to the touch, shivering, or excessive panting. If you suspect your dog has a fever, it is advisable to consult your veterinarian for proper evaluation.

Joint pain can also be a significant indicator of underlying health issues. If your dog is limping, avoiding putting weight on a limb, or showing signs of discomfort when touched, these could be symptoms of conditions such as Lyme disease or other tick-related illnesses. Monitoring your dog’s movements and behaviors closely is essential.

In summary, if your dog displays any persistent symptoms such as lethargy, fever, or joint pain, do not hesitate to seek veterinary assistance. Early diagnosis and treatment can make a significant difference in your dog’s recovery and overall health.

Conclusion: Keeping Your Dog Safe from Ticks

As a responsible dog owner, it is your duty to ensure the health and safety of your furry friend. Monitoring for tick bites is not just a precaution; it is an essential part of pet care that can significantly affect your dog’s overall well-being. Ticks are more than just a nuisance; they can transmit serious diseases that may jeopardize your dog’s health. Understanding the implications of tick bites is crucial for timely intervention.

To effectively protect your dog, it is important to adopt a proactive approach. This includes:

- Regularly checking your dog for ticks, especially after outdoor activities.

- Utilizing preventative treatments such as topical solutions, collars, and oral medications recommended by your veterinarian.

- Maintaining a clean and tick-free environment in your yard by keeping grass trimmed and removing debris.

In addition to preventive measures, awareness of the symptoms associated with tick bites is vital. Look for signs such as:

- Redness and swelling at the bite site

- Increased scratching or licking

- Behavioral changes indicating discomfort

If you notice any concerning symptoms, it is imperative to consult with your veterinarian promptly. Early detection and treatment can make a significant difference in your dog’s recovery and overall health.

In conclusion, by staying vigilant and informed about tick bites, you can help ensure your dog’s health and well-being. Remember, your proactive measures today can lead to a happier and healthier life for your beloved pet.

Frequently Asked Questions

- What does a tick bite look like on a dog?

A tick bite on a dog may appear as a small red bump or a more noticeable swelling around the bite site. The tick itself might still be attached, and you may notice your dog scratching or licking the area.

- How can I tell if my dog is having a reaction to a tick bite?

Watch for symptoms like redness, swelling, excessive scratching, or licking. If your dog shows signs of discomfort or develops a fever, it’s essential to consult your veterinarian.

- What are the health risks associated with tick bites?

Tick bites can lead to serious health issues, including Lyme disease, Ehrlichiosis, and Anaplasmosis. Early detection and treatment are crucial to prevent complications.

- How can I prevent tick bites on my dog?

Regular tick checks, using tick preventatives like topical treatments or collars, and keeping your yard tidy can significantly reduce the risk of tick bites.

- When should I take my dog to the vet after a tick bite?

If you notice signs of infection such as pus, increased swelling, or if your dog shows persistent symptoms like lethargy or joint pain, it’s time to seek veterinary care.