Chipotle Mexican Grill, also known as CMG, has been making headlines recently as the IBD Stock of the Day. The company’s stock has been on the rise, with a year-to-date gain of over 46%. Investors are gearing up for a 50-for-1 stock split set to take effect on June 26, which has sparked interest in the company’s shares.

Goldman Sachs recently initiated coverage of Chipotle stock with a buy rating and a price target of 3,730, indicating that there may still be room for growth. This comes on the heels of a nearly 89% rally in the stock since October. The upcoming stock split, the first in Chipotle’s 30-year history, is expected to increase liquidity and make trading options easier.

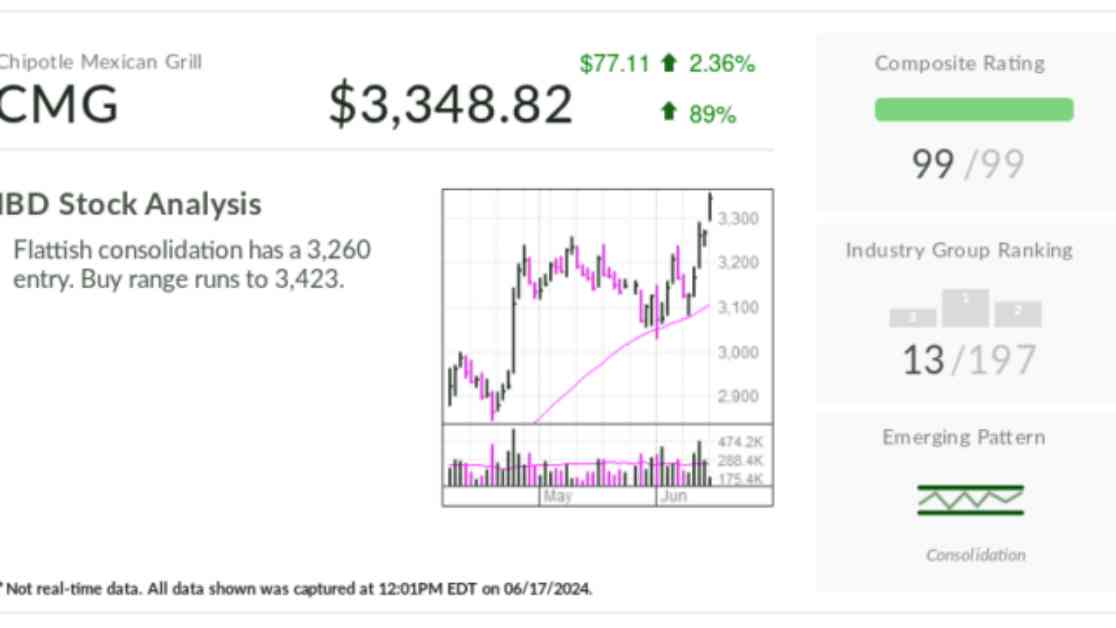

The stock has not built a proper base since a breakout in November but has rebounded from support levels in January and April. Currently, Chipotle shares are in a buy range with a buy point at the May 10 high of 3,260, extending through 3,423. The company is set to release its second-quarter results on July 24, with analysts expecting earnings growth to slow slightly after two consecutive quarters of acceleration.

Chipotle’s stock split will be one of the biggest in the history of the New York Stock Exchange, with shareholders set to receive 49 additional shares for each share held as of June 18. This move aims to spread the market value of the company across a greater number of shares, resulting in a lower price point for the stock. Despite the upcoming split, the total market capitalization of the company and the stock’s chart pattern will remain unchanged.

In Monday’s trading, CMG stock rose 2.9% to 3,365.46, continuing its upward trend. With the stock split on the horizon and positive analyst coverage, Chipotle Mexican Grill continues to be a stock to watch in the coming weeks. Investors will be keeping a close eye on the company’s second-quarter results and how the stock performs post-split on June 26.