The Biden administration recently announced a new rule that could have a significant impact on the financial well-being of millions of Americans. The rule aims to ban medical debt from credit reports, a move that could make it easier for people to qualify for loans, including mortgages and car loans.

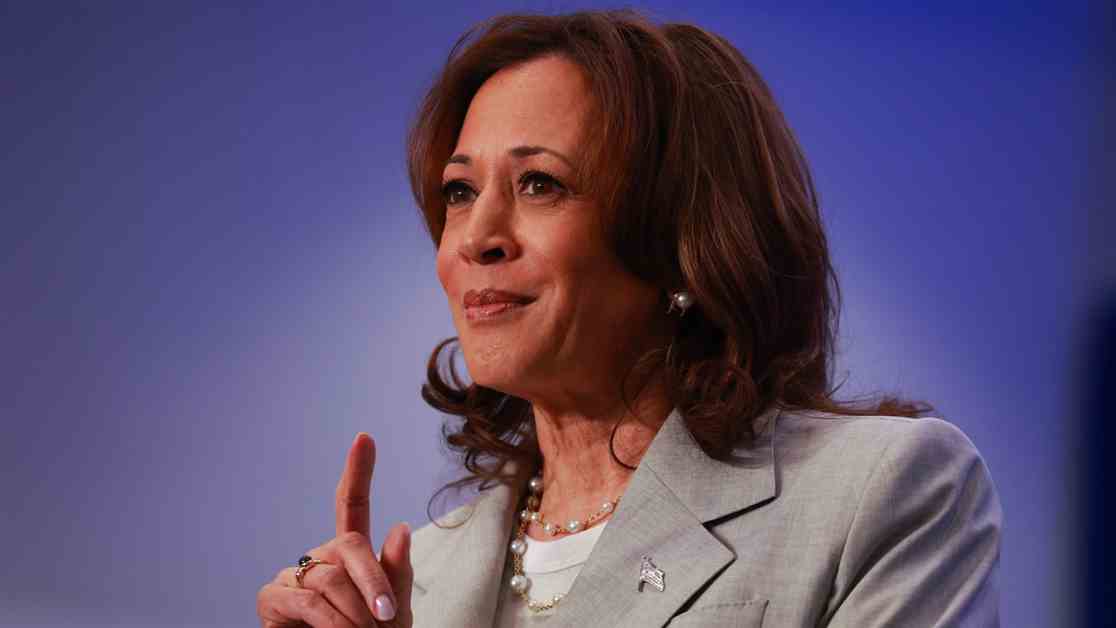

This change, which was proposed by Vice President Kamala Harris and Consumer Financial Protection Bureau Director Rohit Chopra, comes as part of President Joe Biden’s efforts to reduce costs for Americans. Chopra highlighted the unfairness of including medical bills on credit reports, noting that they are not a reliable indicator of a person’s ability to repay other types of loans.

Research conducted by the CFPB suggests that this rule could enable thousands more people to qualify for mortgages each year, benefiting both borrowers and lenders. While some credit report companies have already taken steps to exclude certain medical debt from credit scores, millions of Americans still have significant medical debt that is adversely affecting their credit scores.

Medical debt is a widespread issue in the U.S., impacting a large portion of the population. Individuals like Lexi Coburn have experienced firsthand how medical debt can hinder their ability to secure loans and make financial progress. The new rule not only aims to remove medical debt from credit reports but also addresses the problem of inaccurate and confusing medical bills that often lead to disputes between patients and billing departments.

Despite concerns from some experts and industry groups about the potential negative impact of the rule on businesses and health care providers, Chopra emphasized that individuals who fail to pay their medical bills will still face consequences. The goal of the rule is to ensure that the credit reporting system is not unfairly penalizing individuals who are already struggling with medical debt.

In the long term, addressing the root causes of medical debt in the U.S. will require expanding access to affordable health care coverage. By enrolling more people in comprehensive health insurance plans, policymakers can prevent medical debt from accumulating in the first place, rather than dealing with the consequences on the back end.

While the new rule may face challenges and criticisms from various stakeholders, its potential to alleviate the financial burden of medical debt for millions of Americans is a step in the right direction. By removing this barrier to financial stability, the Biden administration is working to ensure that individuals have the opportunity to access credit and health care without being unduly burdened by past medical expenses.